Is It Shocking How Much Tax You Pay on Gas in New York State?

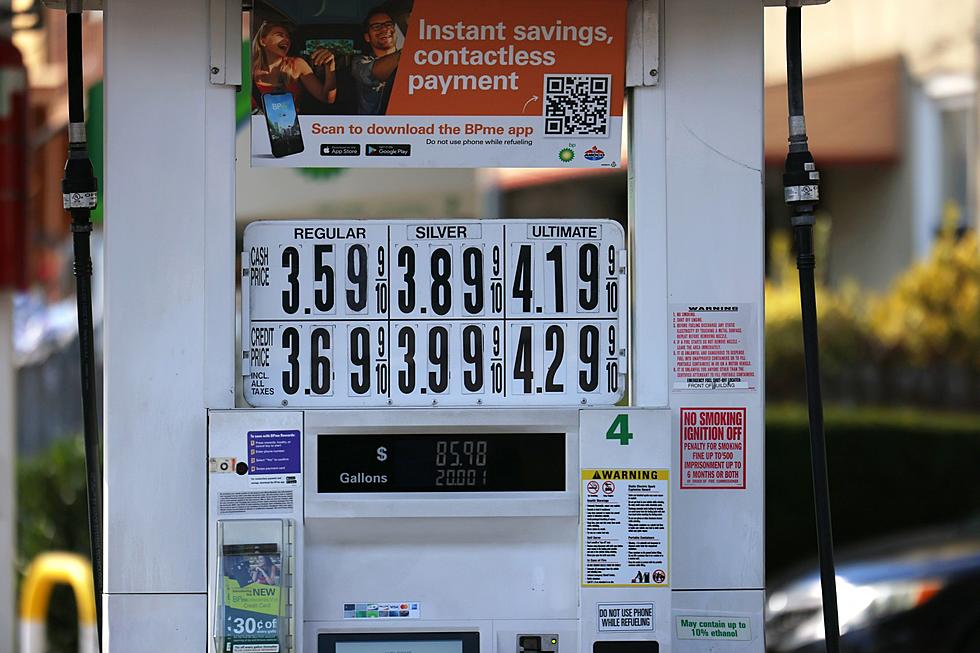

The average price for regular unleaded gasoline in the Hudson Valley region of New York State is hitting between $3.30 and $3.67 a gallon, depending on where exactly you are located.

How much of what you are paying per gallon is New York State taxes? Keep in mind that you have New York State tax and you also have a county tax. While the cost of gasoline is a bit more stable than it has been over the last few weeks, how much is New York getting per gallon of your hard-earned money? It might surprise you.

Will the tax change on the first of the year? That is possible too. Keep reading.

What is the county tax on gasoline in New York State?

The amount of county tax that is being charged does vary by county and these are the rates that are going to be effective as of December 1, 2023, for Hudson Valley counties, the amounts listed are price per gallon.

- Dutchess County, 3 3/4 cents per gallon

- Columbia County, 4 cents per gallon

- Ulster County, 4 cents per gallon

- Putnam County, 4 cents per gallon

- Orange County, 3 3/4 cents per gallon

READ MORE: What to do if you run out of gas?

How much is the New York State tax on gasoline?

How much does New York State get of your hard-earned money for each gallon of gasoline you have to put in the car?

As of November 2023, New York State gets 18 cents per gallon of your money. That 18 cents is for gasoline, it is less for diesel fuel, and doesn't get any of your money if you are using e-85, compressed natural gas, or liquified petroleum gas.

READ MORE: Signs there are skimmers on your gas pump

Over the last three or four years, what has been the least and the most that you have paid per gallon?

LOOK: See how much gasoline cost the year you started driving

Gallery Credit: Sophia Crisafulli

Gallons Of Items That Cost More Than Gasoline

Gallery Credit: Dave Fields

Vintage Antique Chief Gas Gasoline Petroleum Porcelain Sign

Gallery Credit: Kyle Matthews

More From WZAD-WCZX The Wolf